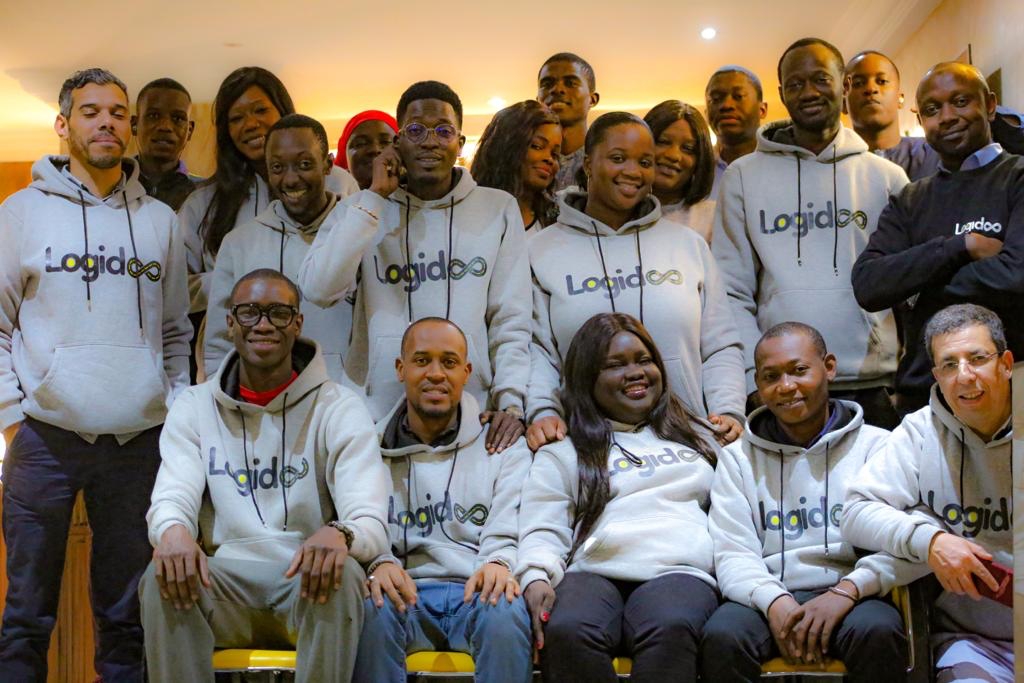

Logidoo extends Casablanca–Dakar corridor to Belgium, strengthening Euro-African trade links

Logidoo, the pan-African cross-border logistics platform, has formally launched its extended Casablanca–Dakar corridor to include Belgium, establishing a new trade artery between Europe, North Africa, and West Africa. Through a recently signed strategic partnership with an undisclosed major Belgian logistics firm, the company now offers regular consolidation services linking Belgium with Morocco and a suite of West African destinations.

The move aims to support European manufacturers, exporters, and e-commerce businesses looking for easier market entry into Africa’s fast-growing economies, particularly those in the Economic Community of West African States (ECOWAS). Logidoo’s CEO, Tamsir Ousmane Traoré, said the initiative reflects the firm’s strategy to position Morocco as a transcontinental logistics hub facilitating flows of goods from Europe to Africa.

The corridor features scheduled groupage shipments from Belgium at competitive rates, parcel drop-off and collection networks across both regions, integrated warehousing, customs clearance, and last-mile delivery options—including cash-on-delivery and secure remittance services, essential in African markets where trust in digital payments remains uneven.

The new corridor represents a significant development for European companies looking to tap into African consumer markets without the complexity of fragmented logistics networks. Traditionally, European exporters seeking African markets face hurdles such as customs delays, inconsistent delivery services, and opaque regulatory environments. By routing goods via Morocco—a country that has aggressively modernized its port infrastructure, notably at Tanger Med—Logidoo offers a streamlined, end-to-end pathway that mitigates such risks.

“Europe-to-Africa trade has often been constrained by a lack of reliable, cost-effective supply chains,” said an industry analyst from the International Transport Forum (ITF), who declined to be named. “By integrating Belgium’s strategic location with Morocco’s port capacity and West Africa’s demand growth, this corridor could reshape regional trade patterns.”

Morocco’s ambition to become a regional logistics hub aligns with Rabat’s broader economic policy to deepen ties with Sub-Saharan Africa while attracting European investment. The government has heavily promoted its logistics clusters and free trade zones to this end. Belgium, for its part, offers logistical advantages through its ports in Antwerp and Zeebrugge, which are gateways to mainland Europe.

For European e-commerce firms, the corridor reduces operational friction. African markets—particularly Nigeria, Senegal, and Côte d’Ivoire—are increasingly viewed as fertile ground for online retail, thanks to young, urbanizing populations and rising digital penetration. Yet logistical uncertainty and last-mile delivery problems have limited the scale of European participation. Logidoo’s service offers tailored solutions to these longstanding gaps, including cash-on-delivery—a critical feature in regions where digital payment adoption is still incomplete.

However, logistical experts warn that successful execution will depend on operational reliability across multiple jurisdictions. “Cross-border trade in Africa is complex due to fragmented infrastructure and regulatory divergence,” said . “Maintaining consistency in customs processing, delivery standards, and service transparency across these markets will be key to sustaining client trust.”

Competition may also intensify. French and Chinese logistics providers are expanding African operations, while domestic African players—such as Kobo360 and Lori Systems—are building technology-driven freight platforms designed to bypass traditional chokepoints.

If successful, the Belgium–Casablanca–Dakar corridor could serve as a template for similar North–South trade routes, potentially spurring other European and African logistics partnerships. The move also underscores Morocco’s strategic positioning in Europe-Africa trade integration and could encourage further investment in cross-border digital infrastructure and customs modernization efforts across West Africa.

For Logidoo, the corridor cements its role as a pioneering African logistics platform poised to benefit from the continent’s projected $450 billion e-commerce market by 2030. As global supply chains shift towards regionalization and diversification, such initiatives highlight the growing importance of Africa in international trade flows.

Whether others follow Logidoo’s lead remains to be seen. But as trade corridors realign in a volatile global economy, this new Euro-African route could prove to be a prescient move.